Matters Graph is purpose-built to serve private equity and corporate M&A teams with better buy-side Commercial Due Diligence and post-investment value gen Commercial Diligence support, providing true crack-the-[investment]-case capabilities.

Matters Graph's Mantra: Make the Diligence matter. Go the extra mile—recognize that good enough is never sufficient. Remain focused as a specialist, honing the craft and serving as a cherished value-add partner. Discover better methods and make everything best-in-class to improve clients' investment returns. If a project falls outside our sweet spot, do not risk clients' time and money.

Our firm is hell-bent on helping identify and resolve the critical matters that drive customer behavior and investment return: if the market is conducive (i.e., attractive), if the business is wired in advantageous ways serving the right segments of customers, and if the underwriting can take advantage of great Diligence, then investment returns will be greater. Matters Graph believes that customer-centric Diligence is the basis for sound commercial Diligence.

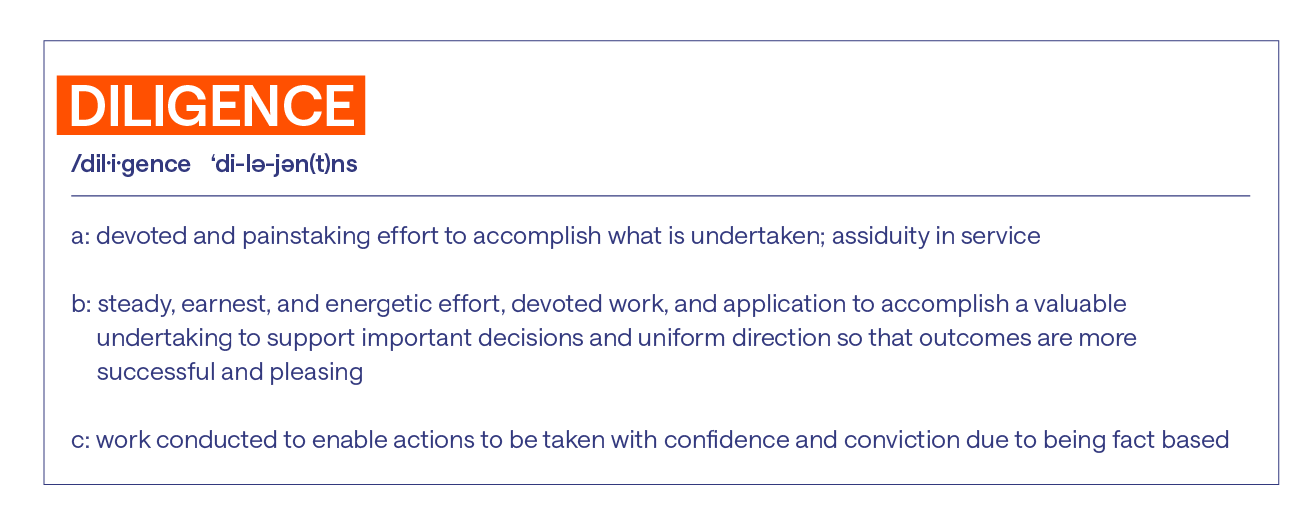

Our firm supports clients with rigorous, evidence-based commercial due Diligence, anchored in differentiated insights from a rich Voice of Customer and Voice Channel perspective. These insights are differentiated and proprietary, and they infuse the classic Commercial Diligence scope—both the market work and the necessary investment thesis pressure testing. We deeply understand that diligent work product cannot afford to be perfunctory, off-target, or informed by reported "experts" (often retired executives participating in expert networks). Our mandate should serve as a valuable lever in your underwriting and value generation.

Commercial Diligence should matter. When done well, Commercial Diligence is revered as a high-value exercise that materially drives investment performance.

Commercial Diligence provides a fantastic opportunity to reduce the chance of costly years-long dig-out slogs that suppress investment returns (and careers). No one should treat Diligence as an exercise that aims to minimize friction in the IC process. Diligence, instead, needs to be handled in a manner that strengthens investment decisions and treats findings that indicate a weakness as an opportunity for the value gen plan and better underwriting.

Every member of the investment and Diligence team must be vigilant against the temptation to declare the answer and mistake what is honestly only a thesis for a valid evidence-based conclusion. The objective is not to build confidence in the provisional investment thesis; rather, the aim is to arrive at valid conclusions. We all must have religion that employs [Diligence] best practice as primary and immutable.

Matters Graph understands the ins and outs of deals—and works as your partner through the challenging reality of competitive processes. We help Principal Investors and lenders to achieve advantageous positions relative to other bidders, while providing sober views on what will challenge the business.

Matters Graph's bespoke and differentiated model brings a real-world perspective to commercial due Diligence—we aim to achieve twin objectives in every assignment:

- Making the Diligence matter; and

- Helping investors be more effective owners/stakeholders.

We designed Matters Graph to "crack the (investment) case," build conviction that is grounded in relevant facts, and provide Commercial Diligence that proves to matter:

- We only support the buy side (i.e., the firm does not offer VDD/syndicated sell-side services), so that we maintain a far greater level of integrity in the work

- Sell-side or Vendor Due Diligence calls for, and develops, a very different orientation—valuable for facilitating selling processes, but weakens discerning muscles and inhibits a scrutinous mind

- We deploy Voice of Customer and Channel research with exceptionalism, providing a view into what lies ahead for target companies, not just what's there today

- Voice of the Customer is not a check-the-box perfunctory exercise; it is a social science that demands effective framing skills, deep listening (for nuance and distinction), and strong business analytics. Humans and organizations are complicated, and Diligence requires expertise in discerning and recognizing decision-making reasoning and patterns

- Ensuring that the inputs come from people who have the underlying needs that the target company's goods or services address, i.e., those who are sitting in a seat using a good or service and driving spend decision

- High sample-size investigations, enabling proper behavior and demographic segmentation, and better determination of the SAM, growth opportunity, and thesis pressure-testing

- Cherishing investigative thinking with a flexible, responsive, "fleet-of-foot" mindset