Unlocking transformational growth in an existing business is never easy.

Matters Graph brings superb analysis and creativity, supported by the strongest possible (and bespoke) evidence base rooted in the Voice of Customer, to help you develop an enhanced strategy and achieve your growth objectives.

Matters Graph's Commercial Value Generation (CVG) practice complements our Commercial Due Diligence practice, bringing the same primary research capabilities and deep understanding of our M&A investment support. We bring dedication and focus on transformational value.

Matters Graph's CVG capabilities support leading investors, operating companies, and divisions in:

- Conducting rigorous external investigation to establish the root causes of current business performance—based on a thorough understanding of customer needs and behavior, the competitive landscape, and performance in the minds of users, influencers, and decision makers at customer organizations, and exogenous market conditions

- Resolving valid debates among different team members (either at the parent or the operating company) by bringing sufficient evidence to build consensus and momentum

- Determining a differentiated, actionable commercial strategy linked to the strongest business value drivers

- Supporting the implementation plan: identifying or developing roles and responsibilities, resources, timelines, and enabling materials

- Developing the key performance indicators, and associated measurement systems—collecting market feedback as necessary and advising on ongoing performance improvement systems

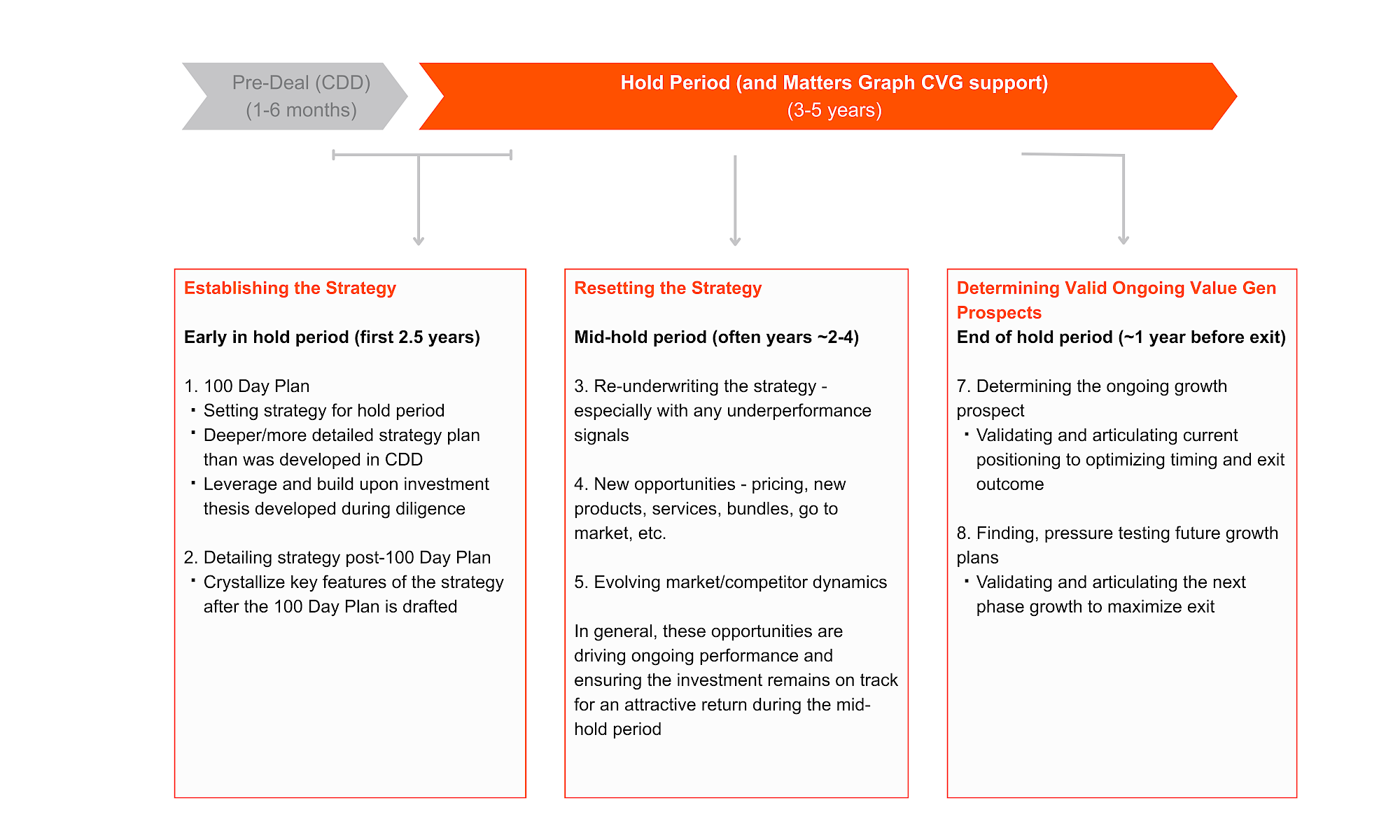

Matters Graph's CVG support can be applied throughout the hold period, from early 100-Day planning work to late-stage growth prospecting to prepare for the next investor or sustained ownership for our corporate clients. Common scenarios Matters Graph has recently supported include:

ESTABLISHING THE STRATEGY

Early in the hold period, typically years 0-2.5, is when most investors and Management teams work to resolve, codify, and document the investment strategy:

- "100-day" planning (including pre-close)

- Set a strategy for the hold period

- Deeper/more detailed strategy planning

- Leverage and build upon the investment thesis developed during Due Diligence

- Detailing strategy post 100-day plan

- Crystalize key features of the strategy, transitioning from strategy to details

Matters Graph's services and support during this period help focus and accelerate the highest-impact commercial components of the strategy setting. Our work covers both (using a classic strategy framework) the "Where to Play"—i.e., market definition, profiling, screening, and selection/prioritization—and "How to Win"—i.e., positioning, product, pricing, go-to-market, promotion, and related tactical considerations. For a more fulsome list of value generation levers, please see our Diligence Matters CVG growth list [here].

As we are not an implementation firm, we never seek to push work beyond the level at which clients are prepared to support themselves. Yet, as entrepreneurs and experienced corporate strategists by background, we understand the bridge from "thinking" to "doing" in strategy. Our recommendations focus on impact: we are happiest when we see tangible signs of activity—such as new product launches, the implementation of new pricing models, or the entry into new markets.

RESETTING THE STRATEGY

During the Mid-hold period (often years ~2-4), investors usually face a series of reevaluations on the business, typically having "matured" the company in many ways, and frequently, having learned some lessons along the way on what works and does not work for the business and its market.

Investors looking to reset the strategy of a portfolio company have typically reached either a low point in business performance or, often, a natural slowing of growth as the early market opportunity has saturated. Our services reflect these client situations. Common "reset" work includes:

- "Re-underwriting" the business and commercial strategy—thoroughly diagnosing why a business is performing the way it is, what runway is left, and what the next stage of the journey for an investor is likely to entail

- "Diligencing" major pivots—confirming that new pricing, products/services, bundles, next-gen product specs, go to market, channels, etc., are valid for growth

- Evolving market/competitor dynamics—assessing and confirming the impact of significant changes to the business and market

Addressing these topics with a robust fact base and set of commercial "Diligence" frameworks allows the board, value gen team, executive leadership, and the supporting Management team to plan rationally around capital allocation and project prioritization.

DETERMINING VALID ONGOING VALUE GEN PROSPECTS AND PREPPING FOR EXIT

At the end of the hold period—often about a year before exit—CVG shifts its focus from articulating what it can achieve during the current hold period to what it can accomplish, including in the next one. While Matters Graph does not conduct sell-side work (see our Differentiators [here]), we do support Management in their planning activities for future growth, and in building a genuine and credible business case and plan for the next leg of success, which often includes:

- Determining the ongoing growth prospect - validating and articulating current positioning to optimize timing and exit outcome

- Identifying and pressure-testing future growth plans - validating and articulating the next phase of growth. Our goal here is to help craft the story that when the next investor conducts robust Diligence, the plan expressed proves to be earnest

The goal of Commercial Value Generation for PE-sponsored Companies is to clarify the Management agenda and prepare for bold action where warranted. Matters Graph's planning support delivers on that goal.

COMMON COMMERCIAL VALUE GEN TOPICS INCLUDE:

Corporate

Strategy & Planning

- Help establish corporate vision, mission, and roadmap

- Set commercial priorities

- Establish strategic initiatives and timeline for completion

- Performance management (e.g., metrics to measure)

Maximizing Growth

within Core Markets

- Identify and refind value proposition with customers

- Refind product to adjust product-market fit

- Better target attractive customer segments

- Modify go-to-market and sales strategy

- Identify cross-sell opportunities

- Perform competitive assessment to refine winning strategy

Price

Improvement Opportunities

- Understand customer willingness to pay - elasticity measurements

- Explore alternative purchase bundles and other pricing/packaging models

- Develop more sophisticated pricing techniques based on key price driving factors

- Architect a value maximizing price/package bundle

M&A

Thesis Development

- Develop thesis framework for evaluating where to play

- Establish M&A criteria for evaluating specific assets

- Develop a target list of companies and evaluate target list against a prioritization filter

- Establish sources of sales-side synergy potential